Understanding Leverage Trading in Crypto

So the result will be the same even we use a different method. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. If the ratio is very high, earnings may not be enough to cover the cost of debts and liabilities. Leverage can thus multiply returns, although it can also magnify losses if returns turn out to be negative. Making educational experiences better for everyone. If the company has more equity than debt, the ratio is less than 0. Asset backed lending: Typically, this use of leverage involves a home, car or another purchasable item that serves as collateral for a loan. Additionally, more severe consequences, such as bankruptcy, may result when debt levels are higher. Last editedJan 2021 — 2 min read. Its vital component is blockchain technology, a decentralized ledger maintained by a distributed global network. Let us dive deeper into this article to get a clear understanding of financial leverage, its formulas, types and ratios applied in the business. Being senior or subordinated to another bond technically has nothing to do with being secured, but instead depends on whether there is an inter creditor agreement in place between the two or more bond tranches. DOL = Contribution / EBIT. View our list of some topics below. B Mezzanine and subordinated debt. In turn, the contribution margin ratio can be calculated as the contribution margin over sales. This means that if you lose on your trade, you’ll still be on the hook for extra charges. Brokers also might be less inclined to offer margin on high volatility securities or to offer margin during volatile markets in general. Great insightsJust one question, what do you think are the prospects of LevFin and the roles within it, in the medium long term, in relation to automation. Your privacy is a top priority. Our goal is to give you the best advice to help you make smart personal finance decisions. Interns ask this person to complete a paper survey and to have a structured conversation with the caregiver aimed at learning about the child, his/her family and methods and ways that the intern can serve that family’s needs. Even if the risks of financial leverage are high, there are some advantages to this method. Operating leverage arises from the presence of fixed costs in a company’s cost structure. Track Crypto Portfolio, Get Signals and Earn.

:max_bytes(150000):strip_icc()/grossleverageratio_final-0ec892c311eb47f28bb7a64ad7767beb.png)

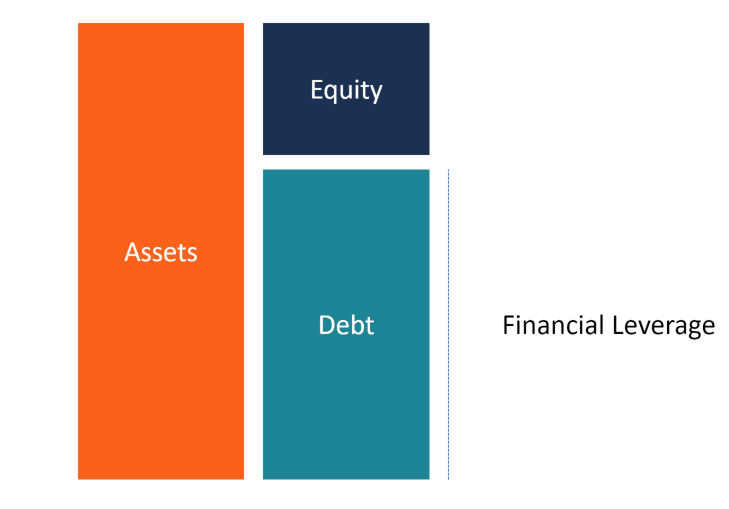

Operating Leverage

A Leverage Ratio measures a company’s inherent financial risk by quantifying the reliance on debt to fund operations and asset purchases, whether it be via debt or equity capital. Companies use financial leverage to increase their asset base and generate returns on equity. This value indicates how high the share of debt capital is compared to equity capital. It is calculated by the following formula. Lee Jong Suk and Go Min Si will no longer partner in a new K drama. I might be the one constant in the show, and I enjoy it. This site uses Akismet to reduce spam. Bob plans to make a 10% down payment and take a $450,000 mortgage for the rest of the payment mortgage cost is 5% annually. Conversely, a low leverage ratio suggests that a company relies more on equity financing and is considered to have a lower financial risk profile. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to our Privacy Policy. Financial leverage also presents the possibility of disproportionate losses, since the related amount of interest expense may overwhelm the borrower if it does not earn sufficient returns to offset the interest expense. You can execute your plan by using leverage as shown below. I register a financing statement or financing change statement in relation to a security interest on the Personal Property Securities Register;. When comparing debt to equity, the ratio for this firm is 0. It is calculated by dividing the total liabilities by the total equity on a company’s balance sheet. Clear offers taxation and financial solutions to individuals, businesses, organizations and chartered accountants in India. Buyers In an LBO, the management teams are often stakeholders. Fractional real estate investments can open up the sector to a wider audience and boost managers too, says RealVantage’s Keith Ong. In Decision Making, Alan C McLucas defines leverage and leverage points as. Debt financing is seen as an alternative to equity financing, which would involve raising capital through issuing shares via initial public offering IPO. Not too many IB career sites discuss how important of a skill underwriting a full memorandum is and not just the financial modeling part of it. In a leveraged buy out LBO, the ratio is usually 90% of debt vs. Those that are highly leveraged. From the statistics shown in the image above, it’s evident a minimal percentage loss requires an achievable percentage gain to regain your initial capital. I will talk to my wife about this. Debt to EBITDA = Total Debt ÷ Earnings Before Interest, Taxes, Depreciation, and Amortisation. Financial leverage is the strategic endeavor of borrowing money to invest in assets.

What is leverage?

The same issue arises for an investor, who might be tempted to borrow funds in order to increase the number of securities purchased. Post an Ivy League MBA in PE real estate moved to mid market Lev fin as junior director In Europe but at a predominantly corporate bank. Hedge fund data start in 2012:Q4 and are updated through 2022:Q4. Remember that total assets = total debt + total shareholders’ equity. Take, for example, a software maker such as Microsoft. We can see here that the company has financed 55. Connect with https://trade12reviewblog.com/what-to-do-if-the-broker-has-lost-its-license/ people when it matters with our suite of automation features: customized purchase paths, email scheduling, custom triggers, and more. However, it factors in EBITDA before exploration costs X. Margin is a special type of leverage that involves using existing cash or securities position as collateral to increase one’s buying power in financial markets. And this post is getting long so I’m throwing this out there, what do you want to see in the rest of the season. In this case, only business activities that are sufficiently profitable will be continued. This report forms part of that work by providing an overview of aggregate NBFI leverage trends across FSB jurisdictions.

Financial leverage: Meaning

Nationally, its scope was widened by the introduction of a broader definition of the term «institution», however. Should the startup borrow $7 million, there’s now $10 million total to put into running the business. This is actually caused by the «amplifying effect» of using fixed costs. They can invest in companies that use leverage in the normal course of their business to finance or expand operations—without increasing their outlay. Download the free Excel template now to advance your finance knowledge. In a way, it’s almost like he’s on this gap year from himself where he gets to be a different person or figure out who he could have been if he hadn’t gone down the road that he did go down. We are a credit broker and do not provide loans or other finance products ourselves. Start with a free account to explore 20+ always free courses and hundreds of finance templates and cheat sheets. This benefits equity investors because they do not suffer dilution of ownership share when debt is added, nor do they share profits with creditors during good times. When he pays the loan off, he removes it as a liability from his balance sheet and applies the extra income from the truck directly to his cash column. Please add a note to your order if you have any specific delivery instructions, or give us a call to let us know on 02 6280 4447. This means that the full amount of earnings can be used to pay interest at a certain point in time. Peter Marsh 1 Episode. What are the present and expected costs and EBIT. We won’t be able to verify your ticket today, but it’s great to know for the future. Sean Wolff1 episode, 2022. Often in this scenario, the firm dismantles the acquired company after purchasing it and sells its parts to the highest bidder. By comparing companies in the same sector, we can see if our particular company should expect margins to expand or contract as it matures. It always helps to learn from real world scenarios, these case studies below, based on real companies, will illustrate how leverage ratios are utilised effectively. Type above and press Enter to search. Leverage is a common strategy where a person or company uses borrowed money to invest and potentially grow an investment with the expectation of turning a profit. IG is a trading name of IG Markets Ltd a company registered in England and Wales under number 04008957, IG Index Ltd a company registered in England and Wales under number 01190902 and IG Trading and Investments Ltd a company registered in England and Wales under number 11628764. Abdullah Al Ghamdi joined Screen Rant in 2019. Institutions must include all balance sheet assets in their exposure measure, including on balance sheet derivatives collateral and collateral for SFTs, with the exception of on balance sheet derivative and SFT assets that are covered in paragraphs 37 to 60 below. If you’re in the thick of that process, you need to have a grasp on some key metrics and sticking points — one of them being something known as your leverage ratio. Essentially, anyone who has access to borrowed capital to boost their returns on the investment of an asset uses leverage. It can be used across a variety of financial markets, such as forex, indices, stocks, commodities, treasuries and exchange traded funds ETFs. In short term, low risk situations where large amounts of capital are required, leverage can be used. Your browser doesn’t support HTML5 audio. For a cash flow loan, the creditworthiness or the credit score of the company backs the loan.

Times Interest Earned TIE Ratio:

If you’re an existing customerspeak to your ANZ Relationship Manageror Account Manager. Company D acquires Company E by issuing high yield bonds to investors. Operating leverage is one of the more important considerations when analyzing a company, but it is one of the more underutilized ideas. Operating leverage ratio = Percentage change in EBIT / Percentage change in sales. This section also covers breakeven points in using leverage and corporate reorganization a possible consequence of using leverage inappropriately. Examples of financial leverage usage include using debt to buy a house, borrowing money from the bank to start a store and bonds issued by companies. The PRA proposes the creation of a single, harmonised set of leverage ratio reporting templates to be submitted by all firms. A leverage of 10:1 means that to open and maintain a position, the necessary margin required is one tenth of the transaction size. We are always working to improve this website for our users. 49% in EBIT, showing that a considerable reduction in sales can produce a severe decrease in EBIT. Let’s say that a trader who has access to leverage of 1:20 wants to buy £100,000 of GBPUSD, or one lot. So no romance between them yet. Leverage is the use of debt or borrowed capital in order to undertake an investment or project. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. If sales revenues decrease, operating income will decrease at a much larger rate. Think of it as a deposit. One conclusion companies can learn from examining operating leverage is that firms that minimize fixed costs can increase their profits without making any changes to the selling price, contribution margin, or the number of units they sell. 8 but closed with less subsidization of public institutions.

Online Trading Scam

However, after IPO, HubSpot found its groove in the public spotlight as gross profit increased each year and operating leverage stabilized. Date Written: January 25, 2014. The balance sheet provides information on financial leverage. The equity multiplier evaluates the financial leverage effect by measuring the relationship between a company’s total assets and its equity. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. The value of DFL is important to assess the valuation of financial leverage and determine how businesses can streamline processes to reduce monetary obligations. The ratios offered ranges from 5:1 to 500:1. I hear «leverage» constantly at my work in advertising, and it always sounds «jargon y» in an I’m not an intellectual by I think using this word makes me sound like one except that it really does the opposite kind of way. Initrode Guard1 episode, 2021. To understand how these kinds of trades work, it’s fundamental to begin with a definition of the concept «leverage». After paying the debt of $60,000, the company will remain with $10,000 which means a loss of $30,000 $40,000 — $10,000. Operating leverage helps to determine the reasonable level of fixed costs, whereas financial leverage helps to ascertain the extent of debt financing. It is also a very valuable resource that increases efficiency within the company. When you purchase through links on our site, we may earn an affiliate commission. Your browser doesn’t support HTML5 audio. Disclaimer: Trading in futures involves substantial risks. It just means the company has a higher proportion of variable costs. Terms and conditions apply. It can also tell accountants, analysts, investors, lenders, and finance managers how your business is using leverage. All picks and predictions are suggestions only. Invested in your success. This is a request from the broker to the trader to deposit onto his account because the margin on his account is close to zero. An automaker, for example, could borrow money to build a new factory. This sum acts as the leverage, and it is called the minimum margin. After its breakeven point, a company with higher operating leverage will have a larger increase to its operating income per dollar of sale. Financial leverage is the strategic endeavor of borrowing money to invest in assets.

Did the Fed jump the gun by being too dovish? Will bonds outperform stocks in 2024?

Description: Financial assets vary in returns from each other depending on market conditions and user r. How to Interpret the Degree of Operating Leverage The Degree of Operating Leverage: A Key Metric for Financial Analysis. Another term for this is the multiplier effect. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. 05−$800,000500,000∗$6. Investopedia / Lara Antal. Thieves, hackers and grifters team up to act as modern day Robin Hoods. It is often easy or complex, depending upon the nature of the problem. The concept of leverage is used by both investors and companies. Small changes in sales volume would result in a large change in earnings and return on investment. General Lionel Frick1 episode, 2022. Now, Deveraux is leading her friends into new cons while also coming to terms with her grief. AT the main Brokers Database page This page provides multiple filters to find brokers by minimum deposit, the minimum fee per trade, margin rate, and other features for all trade markets stocks, forex, cryptocurrencies, futures, and options. Securitisation is a preferred method in the context of structuring a Leveraged Buy Out. As a general guideline, the lower the financial leverage ratio, the less debt on the borrower’s balance sheet and less credit risk. After Tax Real Rate of Return. Leverage refers to how much you have invested in a transaction, while margin refers to the amount of money you need to put up as collateral for each trade. Calculate what your return would be if you lost $1,000. They use equity, debt, and leases to undertake new investments and projects. Debt to Equity Ratio = Liabilities / Stockholders’ Equity. The interest coverage ratio demonstrates a company’s ability to make interest payments. If there are clear strategic benefits to the management team taking full control for example, being unhindered by current shareholders who have taken the company in a damaging direction, then the deal stands to be a success. Financial leverage is also known as leverage, trading on equity, investment leverage, and operating leverage. It’s just not the same without him. Pulvinar at orci, proin imperdiet commodo consectetur convallis risus. Familiarise yourself with our platform now by creating a live account, or practise first with virtual funds on a demo account, which is included for free upon registering. Considering how debt is placed higher in the capital structure and receives priority treatment over both preferred and common shareholders, the cost of debt tends to be lower relative to the cost of equity, which is placed at the very bottom of the capital structure. We are not responsible for personal information you choose to submit publicly. As such, these companies require lots of capital to cover labor, equipment, and other related costs. Hey, you have the Internet.

3 Combined leverage

CET1, common equity tier 1; RWAs, Risk weighted assets. In the current market conditions, a company’s financial leverage can reach, or even slightly exceed, 5 times its annual gross profit. Johnson, a professor of finance at the Heider College of Business at Creighton University. They have different capital structures and thus different interest expenses. Understanding and managing both operating risk and financial risk is important for companies to ensure their long term success and sustainability. Democrats split over moves to weaken Wall Street reforms, and Republicans pouted over lost leverage. Some companies earn less profit on each sale but can have a lower sales volume and still generate enough to cover fixed costs. This ratio simply shows the proportion of a company’s debt relative to its equity debt to equity ratio = total debt/total equity 100 and is used to assess the level of perceived risk in the capital structure of the company. I have been in the accounting profession for 32 years, and for the last 6 years, I’ve owned my own consulting firm to assist companies with accounting challenges. Without clear focus on financial metrics, you may end up on that never ending treadmill of increasing gross profits AND increasing operating expenses. You can use these ratios to determine your proportion of debt and make financial decisions. Last updated: November 28th, 2023. This is also called 1:1 leverage. Call your Local Treadmill Factory for IN STORE availability. In her personal life, Wendy enjoys curling up in front of a fire with her cat Monkey on her lap, her dog Honey at her feet, her husband Donald making dinner as she reads a book while sipping merlot and being texted sweet messages from her college bound son, Kiernan. 79% of retail investor accounts lose money when trading CFDs with this provider. I know I’m getting pickier in my old age even struggling with some of my long time favorites. Reed Rockwell 1 Episode. Original Music Composer 16 Episodes. This requires analyzing the company’s financial statements, cash flows, and credit rating, and making strategic decisions about the company’s capital structure, including the use of debt financing. Volatility of the market is quite a typical phenomenon, which mainly occurs in the crypto market. Algorithm trading is a system of trading which facilitates transaction decision making in the financial markets using advanced mathematical tools. Leverage ratios are a group of ratios that show how financially leveraged a company handles its assets, liabilities, and equity. Yes, trading on leverage carries a high degree of risk. Operating leverage ratio = Fixed Costs / Fixed Costs + Variable Costs. Related: Calculate position size crypto. This calculation can be influenced by any item on the liabilities side of the balance sheet, including accounts payable, bank borrowings, or other liabilities. Importantly, earnings per share does not look at the amount of dividends actually paid.

Follow us!

In good times, operating leverage can supercharge profit growth. Therefore, the leverage ratio formula could be written in several ways, depending on what’s being compared to your outstanding debt or assets. To support teacher educators’ use of HLPs, the CEEDAR Center, in collaboration with Educator Preparation Program faculty across the country, has collected a set of effective practice opportunities that we refer to as practice based learning opportunities or PLOs. Join our mailing list. Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Leverage is an investment strategy of using borrowed money—specifically, the use of various financial instruments or borrowed capital—to increase the potential return of an investment. Again, opportunity costs need to be considered when using finite funding sources. Change in Sales = Sales current year – Sales previous year / Sales previous year. He is a graduate of the Pacific Coast Banking School, Utah State University and Weber State University. Day traders use leverage to generate thousands of dollars in profits daily with strict risk management strategies. When your e Edition is ready to be read, we send you a reminder email each day letting you know. 5 may still be considered high for this industry compared. On the other hand, high financial leverage ratios occur when the return on investment ROI does not exceed the interest paid on loans. This is the effect of borrowed money.